Global Perspectives

What Happened?

September 2025

Taiwan’s top China policymaker issued a stark warning in Washington (Modern Diplomacy). Beijing is preparing to seize the island, potentially triggering a regional crisis (The Week). The timing is particularly concerning, as President Trump has reportedly halted arms deliveries to Taiwan following his recent conversation with Xi Jinping about trade, fentanyl and TikTok (The Guardian).

A Few Words About Taiwan

Taiwan is a vibrant island democracy of 23 million people located off China’s southeast coast. For over 70 years, it has operated as a self-governing territory with its own president, military, and constitution.

The story begins after China’s civil war ended in 1949. At that time, the defeated nationalist government fled to Taiwan, while the communists established the People’s Republic of China on the mainland. Since then, Taiwan has developed into a thriving democracy and major tech hub. Furthermore, the location in the South China Sea makes Taiwan strategically crucial for global trade.

The island maintains close ties with Western countries—especially the United States, which usually provides military support despite not formally recognizing its independence. Meanwhile, China’s government considers Taiwan a breakaway province that must eventually reunify with the mainland in order to accomplish the Chinese Dream. For their part, most Taiwanese prefer maintaining their democratic freedoms and current status, creating ongoing tension in what The Economist called the most dangerous place on Earth.

Why it Matters

Taiwan is central to the U.S.-China conflict; its stability affects U.S. credibility in Asia and allies’ trust. But most importantly, Taiwan’s semiconductor industry is a global chokepoint, manufacturing at least 90% of the most advanced chips, so any disruption could halt high-tech supply chains worldwide. Without U.S. support, Taiwan becomes increasingly vulnerable to Chinese pressure, potentially giving Beijing control over both the world’s most advanced chip production and crucial Pacific shipping lanes. The stakes couldn’t be higher: losing Taiwan would mean China gains leverage over the technology that powers everything from smartphones to military systems, while threatening the democratic order that has kept Asia-Pacific stable for decades.

Mapping the World’s AI Capacity and Chip Supply Chain

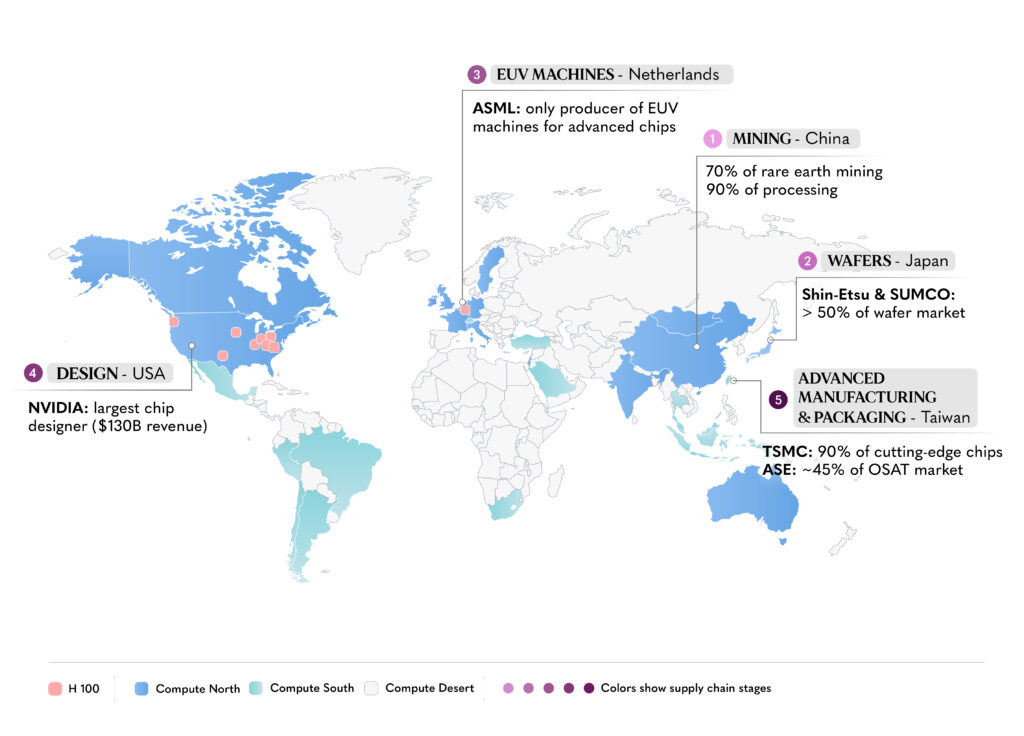

This map reveals a stark reality about our connected world, highlighting distinct digital territories in terms of computing power, access to the most advanced GPUs, and key stress points in the global semiconductor supply chain.

The Great Compute Divide

As the map shows, the world splits into three computational zones. The “Compute North” encompasses regions with abundant AI processing power—predictably including North America, Western Europe, and parts of East Asia. The “Compute South” represents areas with moderate capacity, while vast swaths of the planet fall into what researchers call the “Compute Desert”—regions with little to no access to advanced computing resources. What’s striking isn’t just the familiar North-South divide, but the sheer scale of the Compute Desert, which blankets most of Africa and significant portions of other continents. This digital wasteland represents billions of people cut off from the AI tools increasingly essential for economic participation and development.

The H100 Hierarchy

The map’s second layer reveals an even more concentrated power structure. NVIDIA’s H100 chips—the Ferraris of AI processing, designed specifically for generative AI with performance up to four times superior to previous generations—are almost exclusively clustered in the United States, with just a single deployment in the Netherlands. While Europe maintains substantial A100 capacity and decent GPU access overall, regions like South America and Southeast Asia rely primarily on older V100 chips from 2017—the “first generation” of large-scale AI GPUs that, while groundbreaking for their time, now lag significantly in efficiency and power.

The Design Advantage

Behind this hardware hierarchy lies a deeper truth about technological supremacy. The United States doesn’t just host the most advanced chips—it designs them. Chip design is where the real value gets created: here engineers define processing architecture, circuit logic, performance optimization, energy consumption, AI capabilities, and software compatibility. This design dominance stems from decades of accumulated advantages: world-class research universities, specialized software tools, massive public and private investments, and concentrated talent pools.

The Fragile Web of Global Interdependence

Yet even America’s design supremacy depends on a remarkably specialized global supply chain. China controls essential raw materials—silicon, gallium, germanium, and rare earth elements crucial for advanced transistors and memory circuits. Japan produces the ultra-precise silicon wafers that serve as chip foundations, where even microscopic defects can ruin entire batches. The Netherlands holds perhaps the most critical chokepoint: ASML’s monopoly on Extreme Ultraviolet Lithography machines, the only technology capable of manufacturing chips at 5-nanometer scales and beyond. These machines, costing over $200 million each, represent the pinnacle of precision engineering. But the ultimate bottleneck sits in Taiwan. TSMC and other Taiwanese foundries perform the advanced fabrication and packaging that transforms American designs into functional processors. Without Taiwan’s manufacturing expertise, even the most sophisticated designs and cutting-edge Dutch machines cannot produce working chips.

The $20 Billion Reality Check

Despite mounting geopolitical tensions and ambitious government initiatives like the U.S. CHIPS Act and the European Chips Act aimed at diversifying production, advanced chip manufacturing remains stubbornly concentrated in Taiwan and South Korea. The reasons are as much economic as they are technical.

Building a state-of-the-art semiconductor fabrication facility—or “fab”—now costs upward of $20 billion, representing one of the most capital-intensive industrial investments on Earth. In fact, they represent technological ecosystems that require decades of accumulated expertise, hyper-specialized supply chains, and critical partnerships with equipment suppliers like ASML.

The expertise barrier proves even more daunting than the financial one. Advanced chip manufacturing involves thousands of precisely calibrated steps, each requiring deep institutional knowledge that can’t simply be transferred or replicated. TSMC and Samsung have spent decades refining these processes, training specialized workforces, and building relationships with hundreds of suppliers who must meet impossibly tight specifications.

Even with unlimited funding and political will, establishing comparable manufacturing capabilities elsewhere would require 5 to 10 years of sustained effort and tens of billions in investment—assuming everything goes perfectly. This timeline explains why, despite genuine attempts at diversification, advanced chip manufacturing is likely to remain concentrated in Taiwan and South Korea for the foreseeable future, making these regions indispensable to the global digital economy.

Beyond the Headlines: So What?

The semiconductor landscape exposes a striking paradox: although East and West are locked in strategic competition, they remain utterly dependent on each other’s survival. The rhetoric from Washington to Beijing speaks of technological decoupling, strategic autonomy, and national security imperatives. Political leaders thunder about supply chain independence while imposing export controls and sanctions. Yet beneath this combative surface lies an uncomfortable truth: neither side can actually afford to win decisively.

Consider the absurdity of the current standoff. American companies design the world’s most advanced chips, but they’re worthless without Asian manufacturing. Chinese and Taiwanese factories can produce billions of semiconductors, but without Western design expertise and Dutch lithography machines, they’re manufacturing yesterday’s technology. Europe holds critical chokepoints in manufacturing equipment, but lacks both the design leadership of Silicon Valley and the production scale of East Asia. Remove any major player from the equation, and the entire global digital economy would collapse within months. Smartphones would become impossible to manufacture, data centers would halt expansion, and the AI revolution would grind to a standstill.

Paradoxically, this fragility may be our greatest source of stability. Neither the United States nor China can achieve true technological hegemony without destroying the very system that makes advanced semiconductors possible. Any serious attempt to completely decouple would be economically suicidal—not just for the aggressor, but for the entire interconnected world. This mutual vulnerability creates what strategists might call “MAD for microchips”—a mutually assured destruction scenario where any attempt to fully weaponize the semiconductor supply chain would hurt the aggressor as much as the target.

This situation didn’t emerge from some grand strategic plan or ideological design. It’s the product of decades of accumulated advantages, historical accidents, academic excellence, industrial development patterns, and soft power relationships. These resources can’t be replicated overnight through government spending or political decree. They’re embedded in educational systems, cultural approaches to innovation, accumulated institutional knowledge, and complex webs of supplier relationships that took generations to build.

While East and West remain remarkably balanced in their technological capabilities the true divide runs elsewhere. The map reveals the real losers in our interconnected world: the billions of people in the Compute Desert, shut out from the AI revolution that will define the next century of human development. Africa, much of Latin America, and vast swaths of Asia lack access not just to cutting-edge chips, but to the basic computing infrastructure necessary for economic participation in an increasingly digital world. While the United States and China argue over AI supremacy, entire continents risk being left behind entirely.

The AI race continues, and technological leadership will undoubtedly shift over time. China’s massive investments in domestic chip capabilities, America’s CHIPS Act, Europe’s digital sovereignty initiatives—all represent genuine attempts to reduce dependence and gain advantage. But the current semiconductor geography suggests that any decisive victory remains distant. For now, the most likely scenario isn’t technological decoupling, but rather a prolonged period of competitive interdependence.

Yet perhaps there’s a deeper lesson hidden within this fragile web of global interdependence. The semiconductor supply chain stands as testament to something uniquely human: our ability to achieve extraordinary breakthroughs through diversity of approaches and cultures. American entrepreneurial dynamism, Taiwanese manufacturing precision, Dutch engineering excellence, Japanese materials science—each represents a different cultural approach to innovation, and together they’ve created capabilities that no single nation could achieve alone. Beyond the geopolitical maneuvering and strategic competition, this may be the most important insight: that our greatest technological achievements emerge not from homogeneous thinking, but from the creative friction of different perspectives, values, and methods.

Glossary

- Chip / Microprocessor: Tiny electronic circuits that process and store digital information, essential for smartphones, computers, cars, medical equipment, defense systems, and AI technologies—making them the foundation of virtually every modern industry.

- Semiconductor: A silicon-based material that can conduct electricity under certain conditions, forming the foundation of chips.

- Logic chips: Processors that perform calculations.

- Memory chips: Chips that store data.

- AI Hardware: Specialized chips, like GPUs (Graphics Processing Units), designed to accelerate artificial intelligence computations.

- Compute Power: The capacity of a system to perform processing tasks, often measured in FLOPS or GPU cores.

- Node / Process Node: Manufacturing technology that refers to the smallest feature size that can be manufactured on a chip, e.g., 5nm, 3nm—smaller nodes mean more advanced and efficient chips.

- EDA (Electronic Design Automation): Software tools used to design chips.

- Fabless: Companies (like NVIDIA, AMD) that design chips but don’t manufacture them.

- Wafers: Thin silicon discs where chips are printed.

- EUV lithography: Extreme ultraviolet machines used to etch tiny chip patterns.

- Fab (Fabrication Plant): A physical factory where semiconductor wafers are processed into chips.

- Foundry: A company that owns and operates one or more fabs, manufacturing chips that are designed by other companies (known as fabless firms, like NVIDIA or AMD).

- IDM (Integrated Device Manufacturer): Companies like Intel that both design and manufacture their own chips.

- Die: The individual chip cut from a wafer.

- Yield: The percentage of working chips produced from a wafer.

- Packaging: The process of encasing chips in protective materials with electrical connections.

- OSAT (Outsourced Semiconductor Assembly & Test): Facilities that assemble and test chips after fabrication.

- Hyperscaler: Large cloud providers (like AWS, Google, Microsoft) that operate massive data centers and deploy AI workloads.

- Public cloud regions: Geographically distributed data centers operated by cloud providers (like AWS, Azure, or Google Cloud) that deliver computing, storage, and networking services to customers over the internet.